23+ tax mortgage deduction

Ad Spidell Publishing Inc. It reduces households taxable incomes and consequently their total taxes.

Timely Topic December 2017 Tax Cuts And Jobs Act

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

. Single taxpayers and married taxpayers who file separate returns. View community ranking In the Top 1 of largest communities on Reddit. Web Technically speaking tax credits arent quite the same as tax deductions.

Medical and dental expenses. Web Is mortgage interest tax deductible. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage-related.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web For 2022 theyll get the regular standard deduction of 25900 for a married couple filing jointly. However higher limitations 1 million 500000 if. We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys.

- Your California Federal Tax Solution Since 1975. We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Just remember that under the 2017 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. The current tax law is scheduled to sunset in 2026. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. Ad Get Your Taxes Done w Expert Help In-Office or Virtually or Do Your Own w On-Demand Help.

- Your California Federal Tax Solution Since 1975. By contrast a tax credit is applied directly. They also both get an additional standard deduction amount of.

The standard deduction is increasing to 27700 for married couples filing. That means that the mortgage interest you. Life Has Enough Surprises.

A deduction lowers your income before taxes. 1098 is in both my. Web Deduction CA allowable amount Federal allowable amount.

Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income. Discover Helpful Information And Resources On Taxes From AARP. Web Most homeowners can deduct all of their mortgage interest.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Ad Spidell Publishing Inc. Web Go to tax rtax by misselle70.

Expenses that exceed 75 of your federal AGI. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Web Eligible W-2 employees need to itemize to deduct work expenses.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Expenses that exceed 75 of your. Web For 2021 tax returns the government has raised the standard deduction to.

Web Trumps Tax Cuts and Jobs Act of 2017 lowered the Mortgage interest deduction limit from 1000000 to 750000. Get Upfront Transparent Pricing with HR Block. 12950 for tax year 2022 Married taxpayers who.

Co-borrower mortgage interest deduction. Web Standard deduction rates are as follows. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Is Mortgage Interest Tax Deductible In 2023 Orchard

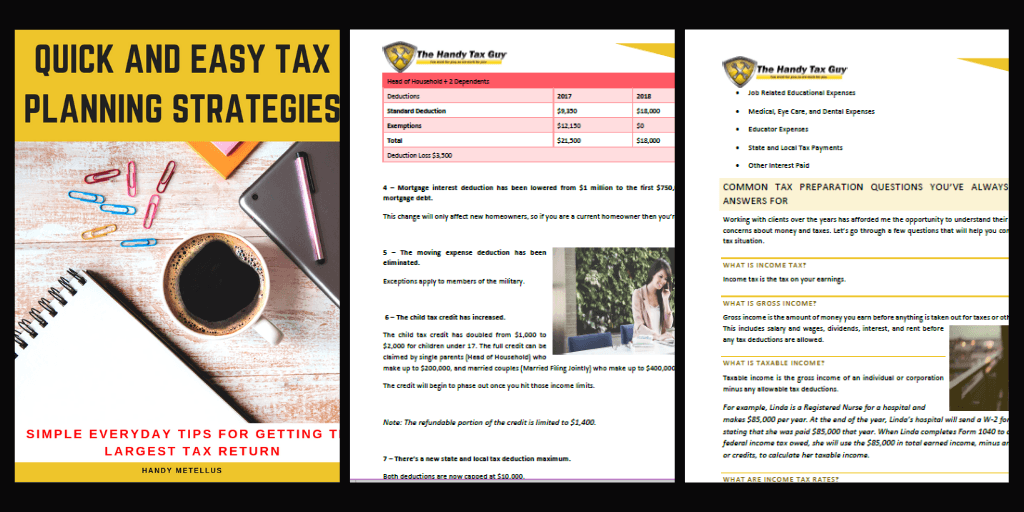

Is Ymca A Tax Exempt Organization Complete Guide The Handy Tax Guy

Scientific Bulletin

Mortgage Interest Deduction How It Calculate Tax Savings

One Of The Ndp Proposals R Canadahousing

It S Tax Time Implications Of Tax Reform For Banks Mercer Capital

The Modified Home Mortgage Interest Deduction

What To Bring To A Tax Appointment Tax Checklists Forms You Must Have The Handy Tax Guy

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Rules Limits For 2023

Bootcamp008 Project F Txt At Master Nycdatasci Bootcamp008 Project Github

Calculating The Home Mortgage Interest Deduction Hmid

Rachele Associates Llc

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Us Tax Changes For 2015 Us Tax Financial Services

Mortgage Interest Deduction Rules Limits For 2023