24+ Paying extra on mortgage

Try this free feature-rich mortgage calculator today. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

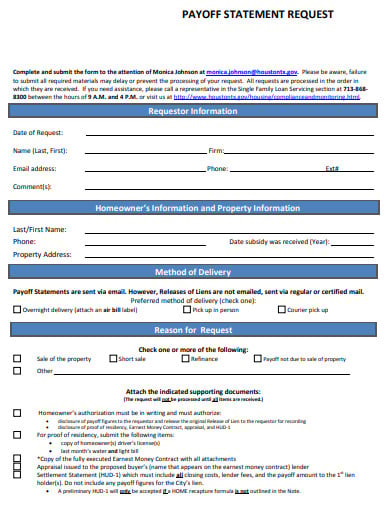

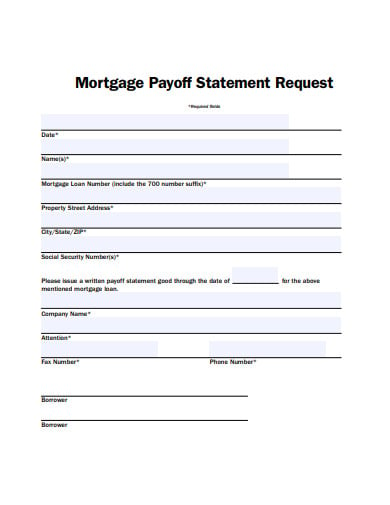

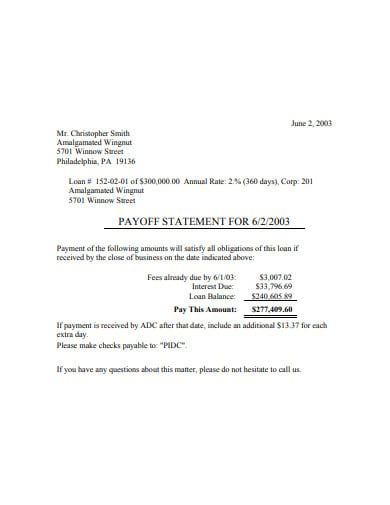

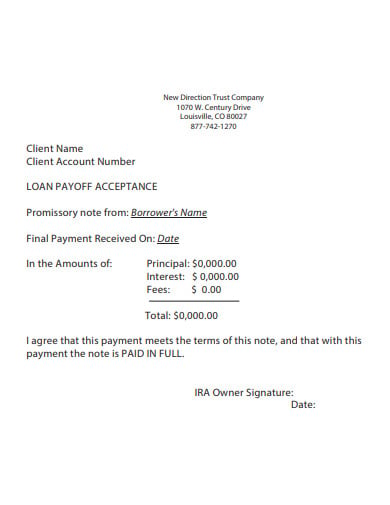

13 Payoff Statement Templates In Pdf Free Premium Templates

This simple technique can shave years off your mortgage and save you thousands of dollars in interest.

. Pay this amount on the mortgage principal. It can help you pay off your debt much more quickly. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Lets say you have a 220000 30-year mortgage with a 4 interest rate.

When you pay extra payments directly on the principal you are lowering the amount that you are paying interest on. Making bi-weekly payments means you need to have extra savings because you will be paying a little. Equity after 5 years.

Youll need to weigh all the factors before deciding whether to commit to biweekly mortgage payments. If your mortgage rate is lower than the inflation rate youll be paying your mortgage back with progressively cheaper dollars. Normally accelerated bi-weekly payments are set up such that each year the total amount of extra payments is equal to one normal monthly payment.

If you would like to pay twice monthly enter 24 or if you would like to pay biweekly enter 26. 2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Paying off your mortgage is one of the most important things that you need to do.

If inflation rises at 4 percent annually and your mortgage stays at 3 percent youve got a pretty good deal. And that means if you add just one extra payment per year youll knock years off the term of your mortgagenot to mention interest savings. Lets consider the pros and cons of entering a biweekly mortgage plan.

This would normally just be 12 months times the Term of the loan except that making extra payments can result in paying off the mortgage early. If half of each of your paychecks goes to your mortgage you still have only 24 mortgage based payments leaving two extra paychecks per year that do not apply. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Paying off your mortgage is a momentous event. Years to pay off. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

The NPER formula is used to. Make Extra House Payments. Meanwhile Chinas jobless rate among people aged between 16 to 24 rose to record highs hitting 193 per cent in June which could add extra pressure on the government.

But before you celebrate follow these steps to make sure your loan is canceled and youre recorded as the sole proprietor of your home. Pay Off Your Mortgage Faster. Bi-Weekly plus Extra Mortgage payment.

To get serious about paying off your mortgage faster here are some ideas to help. Like the extra cash you pay each month this will help reduce the amount you owe thus reducing the amount of. Find Out What You Qualify For.

Make sure you get credit for an extra mortgage payment. Less common ways are in-branch wire transfer phone pay and other means which probably includes paying the mortgage with a credit card. The same principle holds true for any extra money you have while youre still paying off your mortgage.

Michael Saves is a finance blogger who started writing about. The end result of paying every two weeks is youll be paying more every year regardless of whether or not you make extra principal payments in. Some loans will take the extra payments you make and apply them to the interest that has accrued since your last payment and then to the principal amount of the loan.

It offers amortization charts extra payment options payment frequency adjustments and many other useful features. By making one extra payment a year your mortgage will ultimately be paid off faster. Are you paying too much for your mortgage.

In terms of paying we see from the graphic above from the Mortgage Bankers Association that lists the most common ways to pay a mortgage. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. Across the United States 88 of home buyers finance their purchases with a mortgage.

Whether youve got extra money from a raise bonus gift tax return inheritance or even a lucrative night at bingo put it toward the mortgage and get it paid off faster. The fact is that making a commitment to repay your mortgage in 10 20 or 30 years is a good choice. In addition to making extra payments another great way to save money is to lock-in historically low interest rates.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. The top three are auto-pay via the servicer website and by mail. Equity after 10 years.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel.

Mortgage Payment Coloring Printable Tracker 30 Year Journal Etsy Mortgage Payment 30 Year Mortgage Mortgage

Should I Pay Off My Loan Early Advance America

How To Get Out Of Debt Pay Off Debt Or Save Advance America

Payoff Mortgage Early Or Invest The Complete Guide Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

Debt To Income Ratio Advance America

Extra Payment Mortgage Calculator Mortgage Payment Calculator Amortization Schedule Mortgage Calculator

Chris Menard Cmenardvpbmo Twitter

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Payoff Statement Templates In Pdf Free Premium Templates

Free 15 Loan Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

13 Payoff Statement Templates In Pdf Free Premium Templates

Chris Menard Cmenardvpbmo Twitter

The Best Mortgage Calculator With Extra Payments Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Amortization Calculator

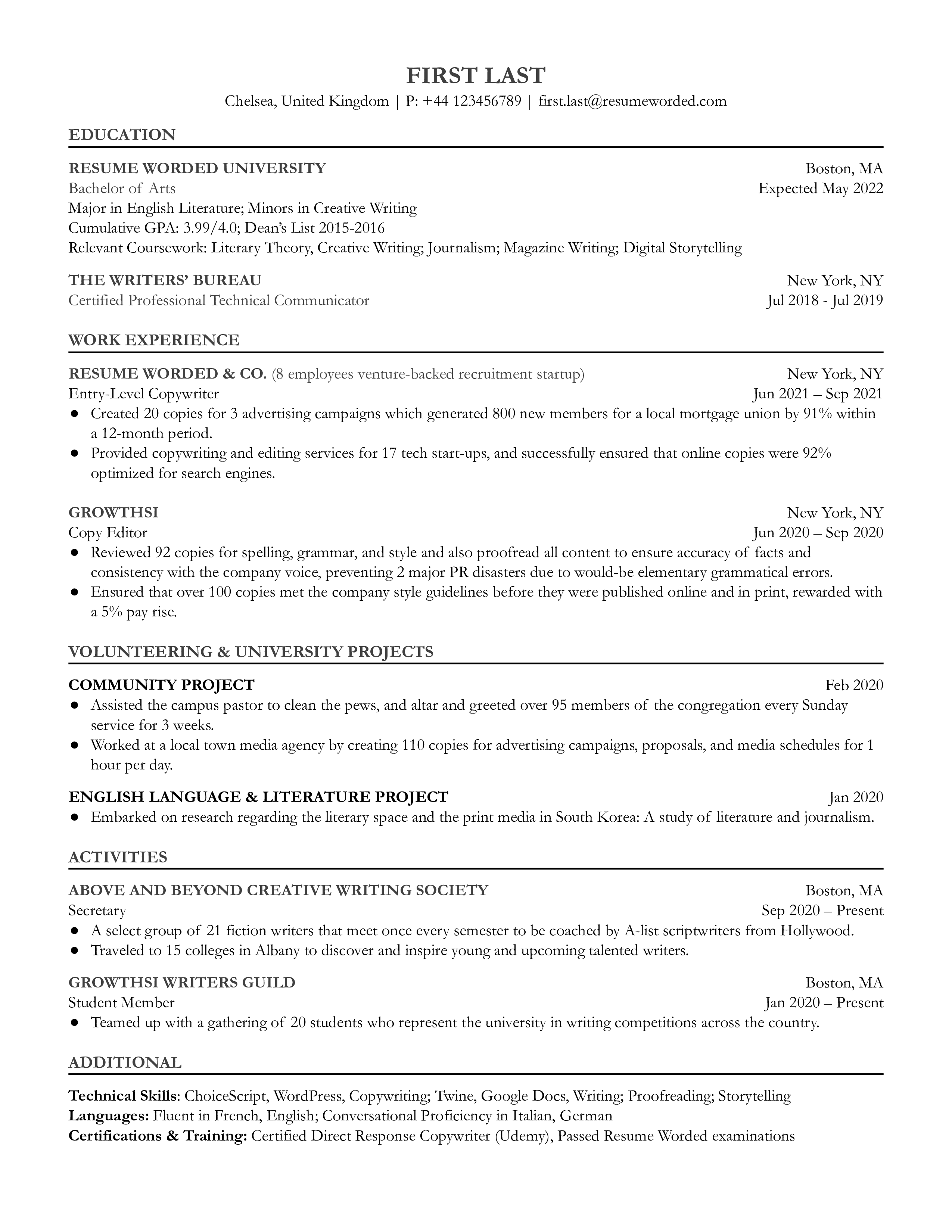

Entry Level Copywriter Resume Example For 2022 Resume Worded

Cmp 15 11 By Key Media Issuu